ARTICLE

FDOT Bulletin EOM 23-01: Review & Analysis

FDOT Bulletin Attempts to De-risk Design-Build Project Delivery with Project-Specific Professional Liability Insurance

FDOT released an Engineering and Operations Memorandum on February 28, 2023, updating their design-build requirements (“the Bulletin”). You can download it here: EOM23-01.

The stated goal of the Bulletin is as follows:

The Department has maintained a very successful Design-build program over the past 20 years. The Department has noticed fewer firms pursuing Design-Build projects and bids on these projects have been coming in increasingly over the Department’s estimates. In an effort to ensure the program remains successful the Department has met with industry and the feedback received is that the amount of risk being put on the Contractors is driving them to make the business decision to not pursue these contracts. These changes are being made to address these concerns.

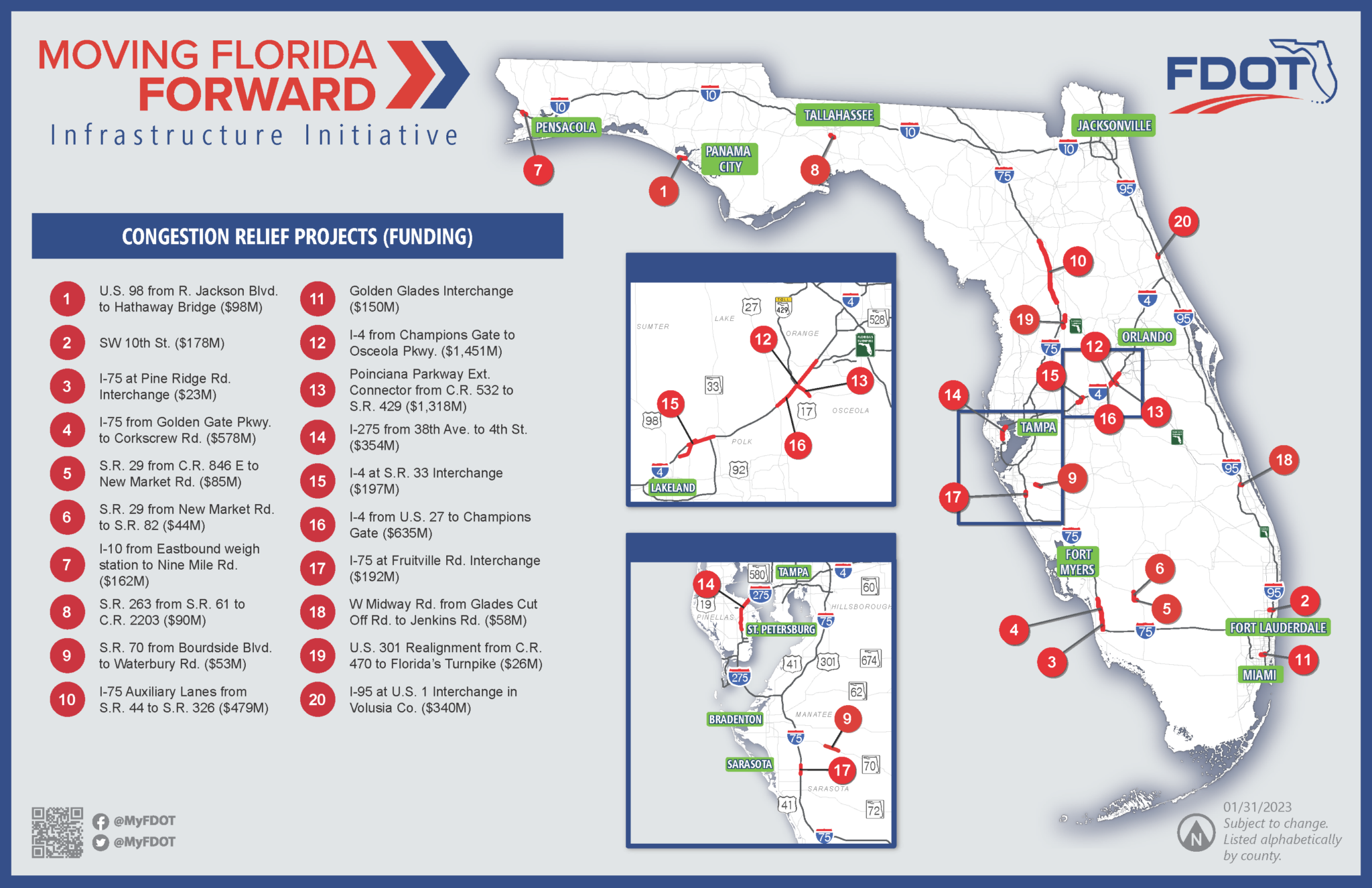

Map of the planned Moving Florida Forward Infrastructure Initiative

Benefits of the Change

The changes in the Bulletin relating to professional liability risk and its implications provide some material benefits:

- PSPL will now be required on many design-build projects in Florida, and the State will bear the cost of the policy premium within the bids submitted by design-builders. This is good news, but bear in mind that the complexity of the PSPL market, coordination of coverage, and the realities of policy language require scrutiny by design firms (see “Additional Aspects to Consider,” below).

- The limits of insurance specified in the Bulletin seem appropriate for general classifications of complexity and construction values (see tables below).

- There is clear focus on creating more certainty around geotechnical reports (subsurface conditions) and addressing (limiting) contractor responsibility for cost overruns.

PSPL LImits

Low Complexity Projects

Total D-B Original Contract Price | Minimum Coverage Limits |

|---|---|

Up to $100 Million | At Design-Build Firm’s Option |

$100 to $250 Million

| $10 Million PSPL coverage |

$250 to $500 Million | $20 Million PSPL coverage |

More than $500 Million | $30 Million PSPL coverage |

High Complexity Projects

Total D-B Original Contract Price | Minimum Coverage Limits |

|---|---|

Up to $100 Million | $10 Million PSPL coverage |

$100 to $250 Million

| $25 Million PSPL coverage |

$250 to $500 Million | $40 Million PSPL coverage |

More than $500 Million | $50 Million PSPL coverage |

Additional Aspects to Consider

- A highly detailed specification of the terms of the PSPL policy should be tailored for an engineering firm’s project involvement.

- An extended reporting period duration (typically of 3-5 years) should be specified.

- Strategize internally, with the assistance of an experienced insurance broker, the foreseeable situation that the limited PSPL market refuses to underwrite a particular project or contractor, or the situation where the FDOT or the design-builder balk at the proposed pricing, which is now commonly several factors of policy limits. A process to address this situation between FDOT and the design-builder should be developed early on in case such a contingency arises during negotiations.

- Engineering firms and contractors alike should take particular note of the fact that both PSPL policies (procured by the engineer) and Contractor’s Protective Professional Indemnity (CPPI) policies (procured by the contractor) typically contain Insured-Versus-Insured Exclusions that negate coverage for claims between the contractor and engineer and vice-versa. Greyling clients should be aware that being named on the same policy as the contractor will effectively prevent the PSPL or CPPI policy from responding in the event of a claim made by the contractor against the engineer. This will place the engineer’s primary practice policy front-and-center (remember that all PL policies have eroding limits and are not separately designated for one project) and expose the firm to potentially uninsured risk. Because the largest claims that engineers face at this time are those from contractors on design-build projects, prudence dictates that engineers be the only named insureds on their PSPL policies. We recommend that firms address with us the common PSPL Insured-Versus-Insured Exclusion and how the contractor may not be able to use the PSPL policy for a claim against a named insured design professional in the hopes of prosecuting a covered claim. All parties who will be named insureds on the PSPL need to understand the consequences of this exclusion and should negotiate over whether to request its removal from the PSPL (if removal is commercially available) policy and what that will mean (e.g., erosion of the policy limits by either defense costs or indemnity in a claim by the design-builder against the engineer; inevitable increased premiums should the insurer agree to remove this exclusion).

- Firms should negotiate with design-builders and the FDOT risk exposures such as cost overrun exposure created by the contractor based on quantity growth as design develops or due to the contractor’s bidding and procurement practices (the Bulletin does not address the other underlying causes of design-build risk for an engineering firm beyond greater subsurface risk uncertainty). We submit that adoption of true Progressive Design-Build would likely alleviate this recurring risk issue that has become one of the industry’s leading driver of claims.

- Firms should bear in mind that many PSPL placements entail cost and schedule audits that commonly generate significant additional premiums at policy termination; firms should bring to FDOT’s attention that it needs to be prepared to pay not only for the upfront costs but for these continuing costs as well.

Recommendations

- Coordinate with the design-builder before the PSPL is priced so that the design-builder can have input on carrier, terms, extended reporting period, etc., before the policy and price are submitted to FDOT.

- Greyling can provide indicative pricing and terms for this purpose based on our extensive experience with PSPL products, carriers, and numerous clients who have been active in design-build.

- Coordinate with the design-builder to include an extended reporting period in the PSPL quote.

- Based on the project type, Greyling can recommend an appropriate extended reporting period.

- Coordinate with the design-builder to determine how to communicate with FDOT that limits MAY NOT be available exclusively to FDOT in order to mitigate potential claims against an engineering firm’s underlying primary practice policy.

- Greyling provides solutions to this issue.

- Because no updated procedures can be all things to all situations, firms will need to continue to follow best practices to mitigate these risks.

- Greyling provides focused risk management seminars for design-build risks from both the design firm’s and the contractor’s perspectives.

- A teaming agreement complete with a “term sheet” containing agreed-upon terms, conditions, and definitions (e.g., indemnification, standard of care, estimated quantities, bid price contingencies) between engineer and design-builder should be generated as early in the process as possible – preferably prior to responding to an RFP, SOQ, etc. – to address the most critical (and contentious) contract terms.

- Greyling has extensive experience assisting clients with both contract review and providing sample teaming agreements with a comprehensive set of terms subject to negotiation and discussion between the parties, including methods to deal with cost overruns that may emanate from preliminary design documents.

- Address with the design-builder and the FDOT whether the PSPL will cover just the design team or also provide Contractor Professional Protective Indemnity (CPPI) coverage for the design-builder.

- Greyling provides brokering, counsel, and advice to designers and contractors on PSPL, CPPI, and the entire menu of project-specific products that are available in the marketplace.

- Proactively confront the reality that PSPL policies routinely require self-insured retentions (SIRs) and deductibles of at least $1 million. Many engineering firms’ and their subconsultants’ SIRs are not nearly as high as $1 million. So, what happens when design firms and their subs that have five-figure or six-figure SIRs find themselves covered by a PSPL policy that requires that they satisfy a $1 million SIR before the policy will provide coverage?

- Greyling can assist firms who are facing high SIRs under a PSPL by placing “deductible gap” coverage (separately or via endorsement) to bridge the gap between the firm’s everyday SIR or deductible under its primary practice policy and that required by the PSPL.

- Negotiate with the FDOT in an effort to have the premiums and costs associated with procurement of “deductible gap” coverage borne by the FDOT as a reimbursable cost associated with the now-mandatory PSPL under the Bulletin.

Conclusion

The policy changes implemented in the Bulletin mitigate, to an extent, the risks inherent in design-build for engineering firms, and signal that the FDOT, and perhaps other institutions and project owners, is not only aware of the level of risk associated with design-build but is taking steps to address those concerns. The recommendations and analysis provided in this publication provide engineering firms with tools to enhance the advancements made in the Bulletin until such time that FDOT policy is further refined through implementation of its new approach to PSPL and design-build risk overall.

Contact Greyling Insurance Brokerage & Risk Consulting today and come be EPIC with us.

AUTHOR

Roger Guilian, JD

Roger Guilian joined Greyling Insurance Brokerage & Risk Consulting, a division of EPIC Insurance Brokers & Consultants, bringing 24+ years of litigation and risk management experience to the Architects & Engineers team. In his role, Roger develops legal and legislative initiatives that are critical to large design firms and the construction community, provide risk avoidance and management consulting to Greyling clients and associates, and support Greyling’s expansion of the ACEC Business Insurance Trust program.

Roger Guilian entered the engineering and design professional space in August 2004 when he became General Counsel of Volkert, Inc., an ENR Top-100 civil engineering firm, after a rewarding and successful sixyear career in private practice. Prior to going in-house, Roger was an active litigator, trying dozens of insurance defense jury trials, and litigating hundreds of suits to favorable pre-trial resolutions. During 18- year in-house experience, Roger gained extensive experience and knowledge in matters affecting risk and legal exposure to engineers, their firms, and other design professionals, including contracts risk management, professional liability insurance, and defense of errors & omissions claims.

Roger is a 1995 magna cum laude graduate of The University of Alabama and a 1998 graduate of The University of Alabama School of Law where he excelled as an advocate on the Law School’s championship Trial Advocacy Competition teams. Roger is deeply engaged in industry and engineering associations through which he has cultivated a nationwide network of friends and colleagues in the design professional insurance and risk management space. Roger currently serves on the American Council of Engineering Companies (ACEC) Risk Management Committee, ACEC Business Resources & Education Committee, ACEC Management Practices Committee, and the American Bar Association’s Construction Law Forum. Roger served as a Trustee on the ACEC Business Insurance Trust from 2020-2022, was an active contributing member of the ACEC Legal Counsel Forum from 2007-2022, and chaired the Alabama State Bar Construction Law Section in 2018.

Roger is a member in good standing of the Alabama State Bar and the Bar of the Supreme Court of the United States.