Why Greyling

Why Firms Switch to Greyling

Most firms that have switched to Greyling made their decision based on three criteria:

- Relationships

- Referrals

- Data & Analytics

And while all three are important, the third step in the process – data and analytics – is what convinces most firms to ultimately switch to and work with Greyling.

Consider how data is used in making many decisions

When leasing new space, your commercial real estate broker will give you pricing on “comps.” The same is true when buying a new home. And when your clients ask you to design a new structure, your firm’s professionals use data to determine how the project will fit into the budget.

Greyling takes the same approach with commercial insurance. We maintain a national database that allows us to use data, not guesses on what the “market” will or won’t do, to analyze an insurance program. We’ve developed this approach into a series of steps, a consistent process that delivers results.

We offer a comparative benchmark analysis

Connect with us to schedule a no-strings-attached review of your firm’s insurance program

Our process:

data & analytics

Step 1: Data Collection

An analysis based on data and metrics, of course, requires initial information for comparison purposes. This includes a copy of current policies, renewal applications for key coverages such as professional liability, and a rough idea of loss history for each line of coverage – good, fair, poor, etc. A checklist is provided.

Step 1: Data Collection

An analysis based on data and metrics, of course, requires initial information for comparison purposes. This includes a copy of current policies, renewal applications for key coverages such as professional liability, and a rough idea of loss history for each line of coverage – good, fair, poor, etc. A checklist is provided.

Step 2: Program Analysis

Once the baseline information is collected, Greyling assigns a team of specialists to analyze information, including coverage, policy limits, deductibles, and self-insured retentions (SIR) and risk funding. The program analysis includes a full review of a firm’s exposures and analysis of policies to see if they match up. Because most insurance policies are “off-the-shelf one-size-fits-all” disconnects are common. Here are a few examples:

- Insured works for public entities and policy excludes all government work

- Hydrographic survey equipment is used underwater but only covered when not in the water

- Ancillary professional consulting services are uninsured

- Projects in the Middle East require local admitted coverage but it is not provided

- Certain employees are eligible for federal workers' compensation benefits, but exposure is not covered

- Fraudulent transfer of funds via cyber theft is not covered

- Property in a flood zone is not insured for flood

Step 2: Program Analysis

Once the baseline information is collected, Greyling assigns a team of specialists to analyze information, including coverage, policy limits, deductibles, and self-insured retentions (SIR) and risk funding. The program analysis includes a full review of a firm’s exposures and analysis of policies to see if they match up. Because most insurance policies are “off-the-shelf one-size-fits-all” disconnects are common. Here are a few examples:

- Insured works for public entities and policy excludes all government work

- Hydrographic survey equipment is used underwater but only covered when not in the water

- Ancillary professional consulting services are uninsured

- Projects in the Middle East require local admitted coverage but it is not provided

- Certain employees are eligible for federal workers' compensation benefits, but exposure is not covered

- Fraudulent transfer of funds via cyber theft is not covered

- Property in a flood zone is not insured for flood

Step 3: Determine Appropriate Comparables

While no two large design firms are the same, Greyling has data on the insurance programs for enough firms to develop meaningful comparisons. One benefit of our singular national approach is we see firms all over the country. We can compare all aspects of an insurance program from similar firms and provide metrics for low, median, average, and high comparables for cost, limits, and deductibles/SIRs.

Step 3: Determine Appropriate Comparables

While no two large design firms are the same, Greyling has data on the insurance programs for enough firms to develop meaningful comparisons. One benefit of our singular national approach is we see firms all over the country. We can compare all aspects of an insurance program from similar firms and provide metrics for low, median, average, and high comparables for cost, limits, and deductibles/SIRs.

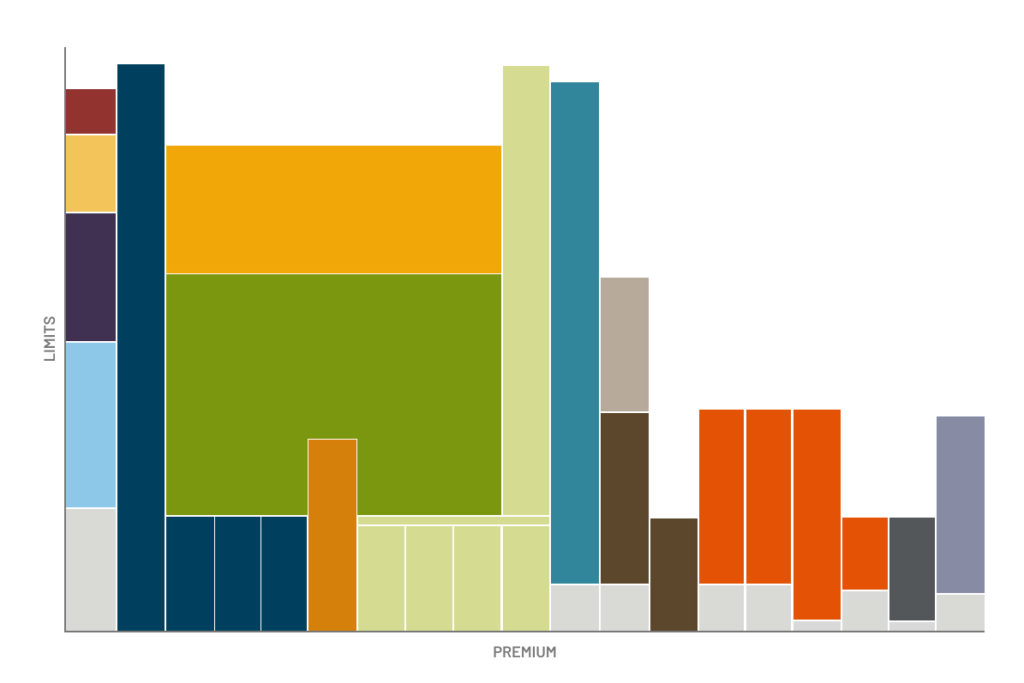

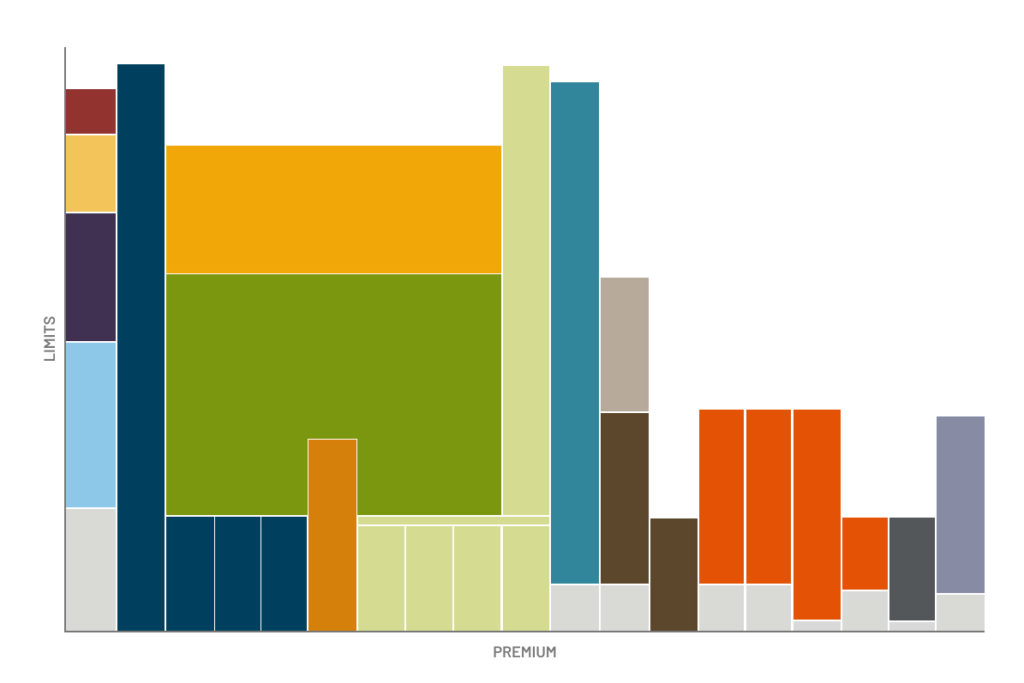

Step 4: Big Chart Analysis

To help insureds better understand their insurance programs, and especially how all policies work together, we develop an illustration of every policy and how they interact. We’ve had some CEOs say that’s the first time they understood what they’ve purchased. Having a clear illustration makes it easier to make informed decisions on changes needed, if any, for the proper level of protection.

Step 4: Big Chart Analysis

To help insureds better understand their insurance programs, and especially how all policies work together, we develop an illustration of every policy and how they interact. We’ve had some CEOs say that’s the first time they understood what they’ve purchased. Having a clear illustration makes it easier to make informed decisions on changes needed, if any, for the proper level of protection.

Big Chart example

Step 5: Present and Review

We then gather the decision-makers to present:

- Coverage: Gaps and fixes (based on what is available) are illustrated on the big chart

- Policy Limits, Deductible/Self-Insured Retention (SIR) and Pricing: Bar charts are provided showing comparative data including average, low and high ranges

Step 5: Present and Review

We then gather the decision-makers to present:

- Coverage: Gaps and fixes (based on what is available) are illustrated on the big chart

- Policy Limits, Deductible/Self-Insured Retention (SIR) and Pricing: Bar charts are provided showing comparative data including average, low and high ranges

Step 6: Implementation

If we end up working together, Greyling is responsible for delivering on the coverage fixes promised and what the benchmark data said about limits, deductibles/SIRs and premiums. On the first renewal, we provide a comparison between what was promised and what was delivered. While results vary from firm to firm, you can download a case study with actual results.

Step 6: Implementation

If we end up working together, Greyling is responsible for delivering on the coverage fixes promised and what the benchmark data said about limits, deductibles/SIRs and premiums. On the first renewal, we provide a comparison between what was promised and what was delivered. While results vary from firm to firm, you can download a case study with actual results.

Why Firms Stay with Greyling

When we end up working with a firm, one of our first deliverables is, as noted above, fixing the identified coverage gaps and bringing the insurance program in line with benchmarks. After we deliver on this promise, we track that the improvements remain in place for years.

However, insurance program design and placement is only part of what we do. Many firms switch to us for this service, but as we work together over time, they begin to understand the breadth of solutions we offer that help improve their bottom line. Learn more about what we do.

Sign Up to Receive Insights from Greyling