PFAS Update

Survey of Environmental Engineering and Consulting Experts: Results & Analysis

In our first Greyling Brief on PFAS in the summer of 2019, we focused on the developing state and federal regulatory environment, the emerging market opportunities for environmental engineers and consultants, and some of the likely challenges faced by these professionals in terms of managing risks.

In the time since, we were curious to see how the environmental consulting and engineering industry is addressing some of the challenges we identified, and others that have subsequently arisen. So, we surveyed experienced environmental consulting and engineering experts focused in this area on a variety of topics dealing with PFAS. We were interested to find out:

- Where they see the federal regulatory regime headed

- Where they see immediate market opportunities and future growth opportunities

- How they are managing risks through contract provisions

- What best practices they have learned in terms of sampling and investigation

- What applied knowledge has evolved in the field

- What new and emerging remedial technologies are showing promise

- How they are dealing with PFAS in terms of ASTM E1527 compliant Phase I ESAs

- What they have learned over the last two years that has surprised them the most

We were particularly interested to learn how environmental firms are using non-insurance strategies (e.g., project selection, contract terms, best practices) to manage risk in the PFAS space.

Our survey results indicate that in emerging risk areas like PFAS, environmental engineers/consultants need expert assistance that may be beyond the understanding and abilities of most insurance brokers. Project selection and risk profiling, contract risk management, and conflicting standards are just a few examples of these important non-insurance risk management considerations.

Introduction

In virtually every area of the environmental consulting/engineering services profession, non-insurance risk management is absolutely critical in the context of strategic, financial and operational success. Adverse contract terms, ambiguous scopes of work, limitations of liability (LoL), standards of care, indemnity terms, selection of projects and clients, quality control, and many other factors are all keys to reducing exposure to litigation, professional liability claims, and draining profits.

In the emerging PFAS space, all of these become even more important. There are additional challenges and uncertainty in all of these areas. Space does not permit a detailed examination of all these challenges, but a single example should suffice.

PFAS remains outside the scope of the updated Phase I Environmental Site Assessment (ESA) standard, ASTM E1527 (updated in November 2021), as the US EPA has not yet designated any of the PFAS compounds as hazardous substances under CERCLA. ASTM’s guidance on the question of whether environmental consultants should include emerging contaminants such as PFAS in their scope of work when conducting Phase I ESAs until such emerging contaminants are regulated as CERCLA hazardous substances is essentially unchanged in the update. ASTM E1527-21 guidance indicates that emerging contaminants can continue to be included as “Non-Scope Considerations.”

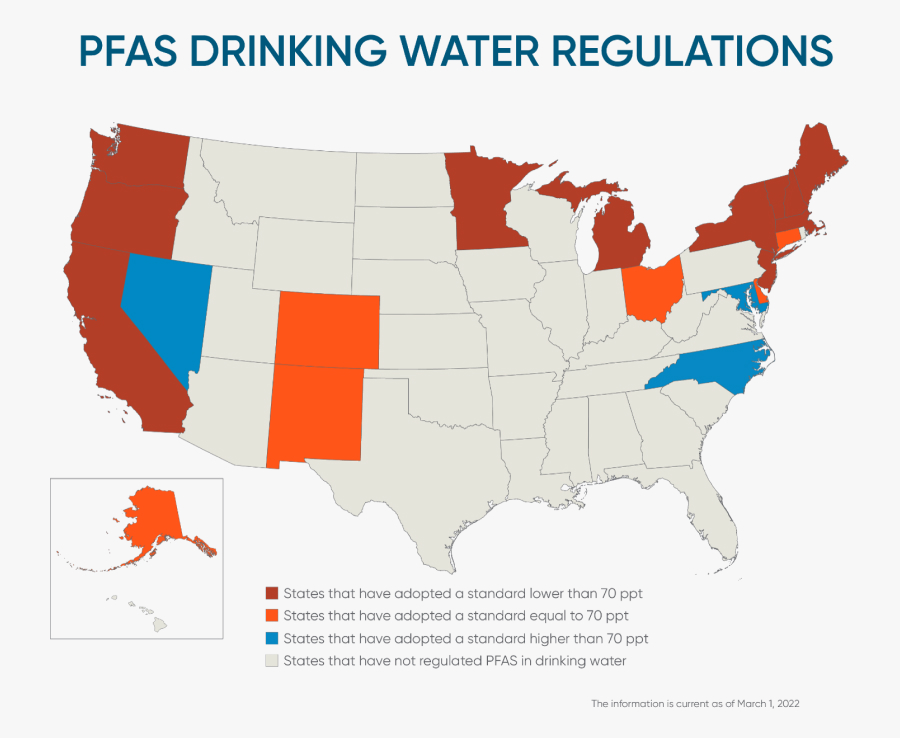

But as our sidebar notes, an increasing number of states have implemented a cleanup standard for at least two PFAS compounds since our summer 2019 Greyling Brief, and an increasing number of states have legislation pending. This also continues to create a variety of risk conundrums for environmental engineers/consultants.

How the industry deals with this uncertainty in their Phase I ESA reports for clients (using only one example: limitation of liability in contracts), how it relates to the standard of care, how to deal with the conflict between AAI under CERCLA and state analogues where non-concurrency on cleanup standards exists, and client/project selection are all critical examples of non-insurance risk management associated with PFAS-related work – and that’s only in a single, specific context!

Survey Summary & Findings

We begin by summarizing the results of certain questions that did not directly bear on issues of risk management per se, or where the survey answers clustered around a common theme.

For example, we asked if respondents think PFAS will be listed as a CERCLA hazardous substance, and if so, why, and when. Nearly all survey respondents answered “yes”, although most do not believe the entire class of PFA compounds will be classified as CERCLA hazardous substances. One presciently suggested a scenario in summer 2021 in which EPA moves to classify at least PFOS and PFOA as U-list RCRA hazardous wastes. (In October 2021, EPA announced it was initiating rulemaking process “for two additional actions to address PFAS under RCRA”).

60% of respondents who believe CERCLA hazardous substance listing is imminent believe it will be on purely scientific grounds. But 40% of the respondents believe hazardous substance listing under CERCLA will occur for qualitative reasons, such as:

- Public awareness

- Sociopolitical momentum and concerns

- Assignment of responsibility for the large number of AFFF-impacted sites

- Removing cost responsibility from municipalities and taxpayers

- Inability to conclude that any levels are safe

We asked whether public or private sector clients are more willing to accept Limitations of Liability (LoL) in contracts for professional services involving PFAS? With one exception, all respondents reported that the private sector is more willing to accept an LoL. We were more interested to learn how that varies by amount of the LoL, and our survey shed some light on that question.

We asked environmental professionals which remediation technologies they have actually specified in PFAS remedial design over the last two years. Granular activated carbon (GAC) and ionic exchange resins were the only technologies reported by respondents.

We asked what promising new remedial technologies they see emerging that will change the time/cost equation vs. GAC for PFAS remediation in groundwater? The most common responses included:

- Ionic exchange resins

- Electro Chemical Oxidation (ECO)

- Phytoremediation

- Gas sparging

- Membrane technologies, specialized coagulants, foam fractionation (for wastewater)

- Encapsulation

- Pyrolysis

- Supercritical waste oxidation

The survey’s key risk management findings, as well as some insights we draw from it, are found in the balance of this Greyling Report.

Where are you seeing market opportunities and where are you engaging (e.g., public vs. private, production vs. downstream, soil vs. groundwater, etc.)?

The majority of survey respondents (approx. 70%) are engaging in private sector work vs. ~30% in public sector work. Most of the public sector work is in DoD facilities related to AFFF’s and at municipal landfills, wastewater treatment facilities, and airports.

Few respondents reported working for clients engaged in production of PFAS compounds (or precursor chemicals). Common private sector industries referenced included pulp/paper, ag/dairy farming, metal plating, electronics manufacturing, law firms (for risk management and litigation), and insurance. (Regarding the last, if your Professional Liability/Contractors Pollution Liability is written by an insurer who also writes site-specific pollution liability, and you have a high level of PFAS expertise, your broker should be making sure to connect those experts with the insurers underwriting and claims staff).

Groundwater was the most commonly reported media in relation to current project focus (>70%). But a plurality of firms referenced increasing work in soil and surface water in relation to increasing concern of environmental regulators. One respondent mentioned that with Toxics Release Inventory (TRI) reporting for almost 200 PFAS compounds for the 2020 reporting year, they expect more opportunities in the private sector, as the public will have increased data on specific industries’ use and volumes of PFAS compounds.

In what % of contracts for services (involving PFAS-related work) are you able to get a limitation of liability (LoL):

a) Equal to the cost of services?

b) Of a fixed amount of $100,000 or less?

c) Of $1,000,000 or less?

d) Up to the limits of your professional liability insurance?

e) In what % are you unable to get ANY LoL and you accept it?

Interestingly, virtually all respondents reported being able to get an LoL equal to the cost of the (PFAS-related) services in ~50% of contracts, and every respondent reported being able to get an LoL equal to the cost of the services in at least 40% of contracts. At the other end of the spectrum, only one respondent reported accepting a contract without any LoL for PFAS-related services but only in ~10% of contracts. Approximately 40% of respondents reported that they would not accept a contract for PFAS-related services with no LoL. Approximately 60% of respondents reported they will accept no LoL, but only in <2% of contracts.

More than 75% of respondents reported keeping LoLs for PFAS-related services below $1 million. The overwhelming majority of firms reported they only provide an LoL up to the firm’s professional liability limits in 10% of contracts, or less.

What best practices have you learned to implement on PFAS site investigation projects?

Respondents reported a wide range of answers. Categorically, the responses centered on the following specific areas:

- Sampling equipment matters (e.g., container/lid types)

- Personal items (food, clothing, cosmetics, etc.) can impact sample results

- Personal Protective Equipment matters

- Rigorous field QC samples (incl. field blanks, source water blanks, equipment rinse blanks, etc.) are critical

- Develop project-specific protocols but with reference to state and ITRC guidelines

- Unique practices for sampling surface water (whether stagnant or flowing)

- Unique practices for dealing with surface soil during boring or well installation

- Unique practices for dealing with surface water, groundwater, wastewater with elevated suspended solids

What unique applied knowledge has evolved in the field over the last two years in this regard ?

Approximately 25% of respondents reported that early concerns about sample contamination issues have proven not to be as serious a concern as initially anticipated.

There were a number of other interesting examples provided, including:

Given that PFAS are not listed as hazardous substances in CERCLA and all state analogues yet (out of scope for ASTM 1527-13/21), how have you been treating them in Phase I ESAs?

Virtually all respondents report addressing PFAS as an out-of-scope item in Phase I ESAs on a client and site-specific basis. The most commonly listed situations were:

- Where site history or activities suggest likelihood of presence

- If requested by the client

- Considering exposure pathways, in particular drinking water sources

- As a “business risk”

Does the above answer change/depend on whether you are advising an owner/PRP vs. a prospective purchaser?

How do you treat the situation if the site is in a state that has implemented an mcl while the federal standard remains a health advisory?

The most common responses were:

- Communication with client early in assessment to establish a general decision framework

- States with regulations in place are the driver of regulatory action over the federal Health Advisory

One respondent replied that their firm treats these situations the same way as in states with no standards – as a business risk.

How have you seen lenders address PFAS in commercial real estate lending due diligence, or are they doing so at all?

Have you seen known or suspected PFAS stop a commercial real estate transaction or commercial lending in support of it?

Given the risks involved, do your projects involving PFAS undergo a separate go/no-go process for contract risk management vs. other types of environmental consulting/engineering work?

What have you learned over the last two years about PFAS in terms of due diligence, site investigation, remedial design, contract risk management, client expectations, market evolution, emerging remedial technologies, or any other facet that has surprised you the most?

The most common responses included:

- How widespread PFAS impacts are across a variety of industries and environmental media

- That states having lower mcl’s than the EPA Health Advisory are not likely to consider site-specific science that the value should be higher

- The lack of significant increase in client work to address PFAS (notes confusion between state and federal agencies)

- How rapidly science is evolving

- How few PFAS compounds characterized in terms of toxicology, fate/transport, distribution and transformation

- Differences in lab analytical procedures (e.g., sample prep, equipment calibration, etc.)

Aside from the chemical manufacturers and airports, where do you see the biggest growth opportunity for your PFAS-related consulting/engineering services (e.g., landfills, municipal water/wastewater systems)?

The most common responses were (without regard to order/frequency):

- Department of Defense sites

- Municipal solid-waste landfills

- Municipal wastewater systems

- Bulk fuel terminals

- Refineries

- Chemical-using industries

- Oil/gas

- Chrome plating

- Pulp/paper

- Litigation/law firms

- Risk management planning (many industries)

- Major industrial fires/explosions

If you have any other (non-insurance) risk management advice for environmental professionals operating in the PFAS space that you are willing to share which we have not touched on, please feel free to provide it here.

Conclusion

Our survey findings reinforce the importance of non-insurance risk management as critical to avoiding claims and litigation costs for environmental engineers and consultants. From an insurance perspective, professional liability (PL) coverage for environmental engineers and consultants requires no modification to address any scope of professional services related to PFAS. No PL insurer operating in this space has (or will likely ever) place any PFAS exclusion on a PL policy in North America (it is worth noting that the opposite is true with regard to site-specific pollution liability policies purchased by facility owners/operators; the recognition of this fact should weigh heavily regarding contract and other non-insurance measures where an environmental professional knows or suspects its work is being relied upon in support of environmental insurance underwriting related to property transactions).

ASTM did not solve the PFAS non-scope question in its E1527-21 standards update. And as our survey results show, there is some divergence in the manner in which industry firms are approaching the issue in their Phase I ESA’s for clients. Because of the dynamic situation with state regulations, we urge caution in exactly how PFAS is addressed as a “non-scope consideration.” This is particularly the case when representing buyers of properties that could be impaired with some form of perfluorinated compound.

If PFAS are not hazardous substances under CERCLA, a discrepancy exists between state equivalents and federal law on the question of landowner liability protections. Until this discrepancy is resolved, does this create the situation where the risk could be greater in transactional scenarios when your firm represents a prospective purchaser than a seller?

Given the ASTM 1527-21 non-scope issue and state/federal regulatory inconsistencies, what exactly is the standard of care? This is a non-trivial question with a non-obvious and evolving answer.

Consider reliance letters, often requested by banks, or sometimes by clients, in relation to past Phase I ESAs. Where uncertainties such as the above exist, does this situation cause an environmental engineer/consultant to pause and reconsider reliance letter requests in relation to past reports? Would you charge the same price, or condition reliance letters in the same manner, where there is now a) a state PFOA or PFOS remediation standard and b) a recognized potential for PFAS impacts at the site that was not considered at the time of the report?

We were very pleased to see that a very large percentage of environmental engineers/consultants are not providing unlimited LoL’s, or even up to their full professional liability limits, for work involving PFAS. We were just as pleased to see that almost half said they would never do so, and those in the remaining balance said they would do so only 2% of the time or less. We believe that this is one of the single most important non-insurance risk management considerations for environmental engineers/consultants.

One area in particular where we advise caution: many firms in the industry operate under some form of master services agreement (MSA). Many of these MSAs have been in force for several years, with terms that were negotiated prior to the emergence of PFAS-related work. The LoL you may have been comfortable offering for other services, contaminants and situations and agreed to in the MSA (think municipal airport RCRA compliance) may not be appropriate for riskier PFAS-related work. Consideration should be given to addressing this (or attempting to) in individual task orders. And when renegotiating MSAs where you know or suspect PFAS-related investigation or consulting work could be part of task orders in the future, consider paring back the LoL in those specific situations. As our survey shows, private sector owners appear to be more favorably predisposed to reasonable LoL’s in this space, so this may be difficult with government entities.

It appears from our survey that many of the initial worries about the risks of widespread sample contamination (equipment, practices, PPE, cross contamination) have not come to fruition. On the other hand, virtually all environmental professionals now recognize that the extent of PFAS contamination is likely far greater than initially feared. Because the landscape of impacted sites is clearly larger than initially thought, environmental professionals will need to be extra careful when considering whether the potential for these compounds may exist, especially in states that have passed or have legislation pending creating a regulatory standard for cleanup.

Finally, we note that while there are a few promising remediation technologies for PFAS emerging, as of yet there is no magic bullet. In these situations, we strongly caution environmental professionals against providing performance guarantees for remediation systems. We have always given this advice even where:

- Remediation technologies are decades old

- Performance metrics and variables are very well understood

- Remediation standards are proven achievable with such technologies

- The standards are represented in parts per million or parts per billion

With currently-practical large-scale PFAS remediation technologies combining with regulatory standards measured in parts per trillion, going out on a limb with performance guarantees is a recipe for trouble. Or worse.

Useful Links:

EPA’s 5th Unregulated Contaminant Monitoring Rule:

https://www.govinfo.gov/content/pkg/FR-2021-12-27/pdf/2021-27858.pdf

EPA Actions to Address PFAS: https://www.epa.gov/pfas/epa-actions-address-pfas

EPA link to U.S. State Resources about PFAS:

https://www.epa.gov/pfas/us-state-resources-about-pfas

Interstate Technology Regulatory Council (ITRC) PFAS Fact Sheets:

https://pfas-1.itrcweb.org/fact-sheets/

State-by-State Regulation of PFAS in Groundwater (4/24/2022):

https://www.jdsupra.com/legalnews/pfas-update-state-by-state-regulation-7249840/

State-by-State Regulation of PFAS in Drinking Water (3/4/22):

https://www.jdsupra.com/legalnews/pfas-update-state-by-state-regulation-4639985/

AUTHOR

ALAN BRESSLER

Alan Bressler is a senior vice president and leader of the environmental practice at Greyling Insurance Brokerage. He is a recognized expert on risk management and insurance issues affecting environmental contractors, consultants, engineers, treatment, storage and disposal facilities, and brownfield redevelopment transactions. Alan is a frequent speaker and writer on environmental risk management topics, including environmental insurance and brownfield redevelopment. He has been regularly published in a wide variety of industry publications, including IRMI.com, The John Liner Review, and Brownfield News & Sustainable Development magazine. He was a member of the Advisory Board for the National Brownfields Association from 2000 – 2009